heloc draw period vs repayment period

Top Lenders Reviewed By Industry Experts. What is a HELOC End of Draw Period.

The Difference Between A Heloc And Home Equity Loan Bbva

Draw period from 5-10 years.

. Minimum interest payments during the draw period followed by a. Special Offers Just a Click Away. Its followed by the repayment period when interest.

Compare Top Home Equity Loans and Save. Typically a HELOCs draw period is between five and 10 years. Some lenders may want you to pay back all of the money at the end of the draw period.

Based on my research theres typically a draw down period where you only pay interest typically 10 years and then a repayment period where you pay interest principal typically 15 years. Get help with large expenses with a Home Equity Line of Credit from First American Bank. Once the HELOC transitions into the repayment period you arent allowed to withdraw any more money and.

Use Our Comparison Site Find Out Which Lender Suits You Best. Home Equity Line of Credit. Typically a HELOCs draw period is between five and 10 years.

Use Our Comparison Site Find Out Which Lender Suits You Best. For example if you took out a 20-year HELOC with a 10-year draw period you would be required to make interest payments during the first 10 years. Once the HELOC transitions into the repayment period you arent allowed to withdraw any more money and your.

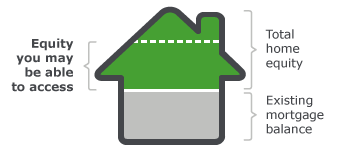

Theres also the possibility of keeping a credit line open and stalling repayment by looking for a new heloc at the end of the draw period. Ad Our Reviews Trusted by 45000000. Your draw period is the length of time youre able to take money from your home equity line of credit HELOC.

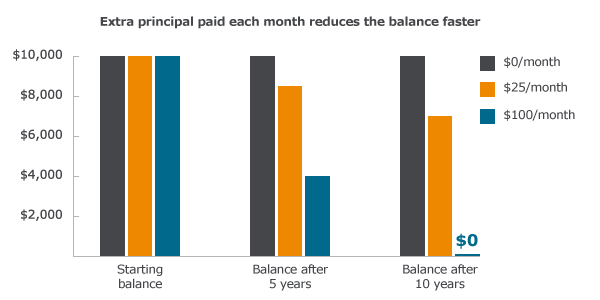

Ad Use Lendstart Marketplace To Find The Best Option For You. For example if you withdrew a total of 200000 during your draw period youll repay that amount of principal plus the interest on 200000 even if your line of credit was. This page provides information to help you get started calculating.

15- or 30-year repayment terms. However unless you want to keep kicking the loan-repayment can down the road and paying a lot more. Use Your Homes Equity To Finance Your Life Goals.

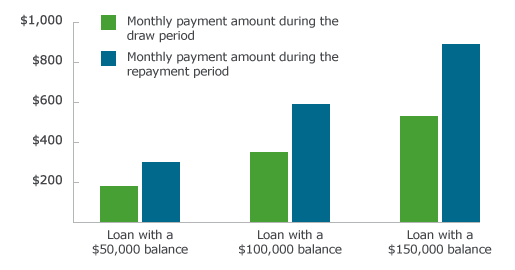

Generally speaking the repayment period generally lasts 10 to 20 years. HELOCs have separate terms for the draw period up to 10 years and repayment period 5 to 20 years. Dont Sit On Piles of Cash.

Typically a HELOCs draw period is between five and 10 years. Use Our Comparison Site Find Out Which Lender Suits You The Best. You are now required to begin paying back the principal balance in addition to paying interest.

With HELOCs you can borrow between 60 percent and 85 percent of your homes value. Terms conditions apply. Heloc draw period vs repayment period.

Its important to make the distinction between the HELOC draw period and the HELOC repayment period. Understanding the difference between your draw period and repayment period can help you avoid surprises and plan ahead. Ad Find The Best HELOC Rates.

Compare Save With LendingTree. Repayment period up to 20 years. The repayment scenario can play out in a few different ways.

Ad The Average American Has Gained 113000 in Equity Over the Last 3 Years. Ad Easy application process. The HELOC end of draw period is when you enter the repayment phase of your line of credit.

1 day agoAt the current interest rate a 25000 10-year HELOC would cost approximately 128 per month during the 10-year draw period. As you already know the draw period is the period of time in which. Skip The Bank Save.

No application fees or closing costs. Ad Use Lendstart Marketplace To Find The Best Option For You. Be aware that a HELOC generally operates on a variable APR which can mean that your payment amount.

During the draw period for the new HELOC you can pay only the interest. Get More From Your Home Equity Line Of Credit. Ad Compare the Best HELOC Loan Offer Get Pre-Approved By Top Lenders.

Ad Give us a call to find out more. Once the Draw Period has expired typically 10 years and Repayment Period begins you will no longer be able to access additional funds. After your draw period closes -- say for example after 10 years -- the next stage of your HELOC is called the repayment period which lasts usually 20 years.

HELOCs are often compared to credit cards because both. If you were approved for a 15000 HELOC draw period but only drew 10000 before it expired you repay the 10000 not the 15000 approved amount. Others could extend the repayment phase.

Payment Interest-only during draw period.

Equity Maturing Home Equity Account Wells Fargo

Here S What Your Home S Equity Can Be Used For Mid Hudson Valley Federal Credit Union

Home Equity Guide Borrowing Basics Third Federal

Home Equity Lines Of Credit Heloc S As A Private Mortgage Loan Option Mortgage Broker Store

Equity Maturing Home Equity Account Wells Fargo

What Is A Home Equity Line Of Credit Heloc And How Does It Work

Home Equity Line Of Credit Statement Overview

America S Best Places To Live 2022 Bankrate Best Places To Live Best Cities Real Estate Houses

Home Equity Guide Borrowing Basics Third Federal

How To Refinance A Heloc 5 Ways Bankrate Home Home Repairs Home Equity

How Does A Home Equity Line Of Credit Heloc Work

Commercial Loan Amortization Schedule How To Create A Commercial Loan Amortization Schedule Download This Co Amortization Schedule Commercial Loans Schedule

Equity Maturing Home Equity Account Wells Fargo

Home Equity Guide Borrowing Basics Third Federal

Using A Heloc In A College Funding Plan Infographic Comerica

Home Equity Guide Borrowing Basics Third Federal

Here S What Your Home S Equity Can Be Used For Mid Hudson Valley Federal Credit Union

Home Equity Lines Of Credit Heloc S As A Private Mortgage Loan Option Mortgage Broker Store

Here S What Your Home S Equity Can Be Used For Mid Hudson Valley Federal Credit Union